does fl have real estate tax

The chief programs in Florida are summarized here. Tax amount varies by county.

Florida Property Taxes Explained

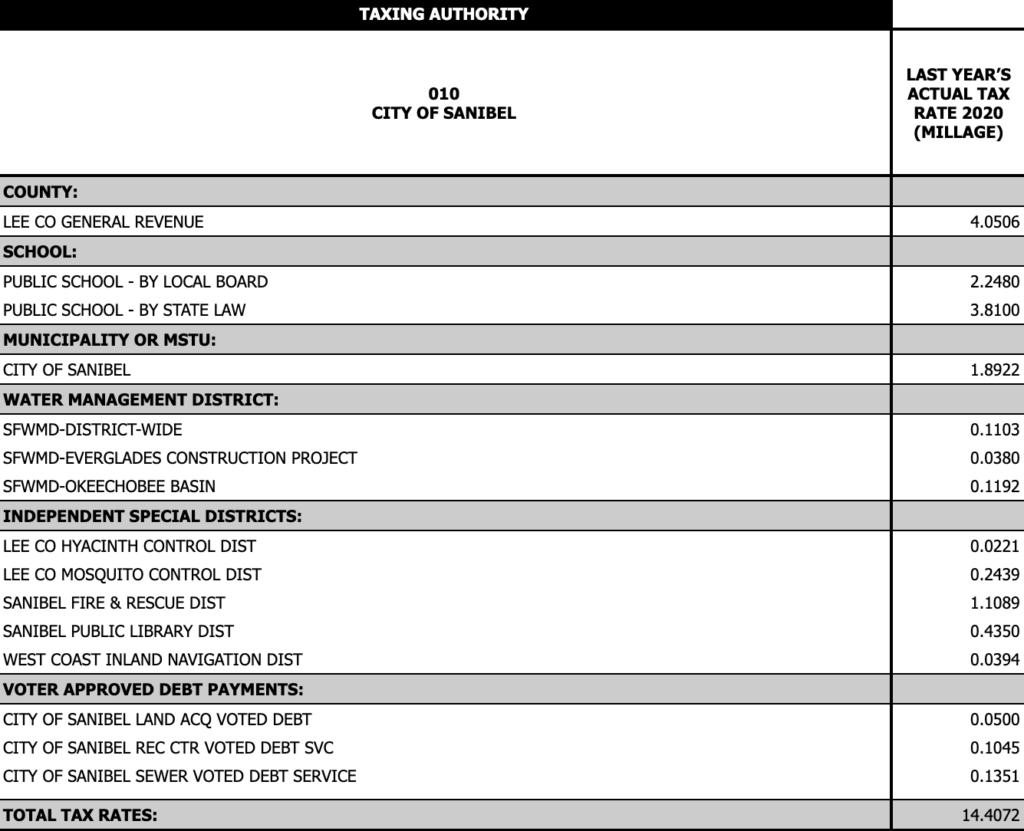

Florida real property tax rates are implemented in millage.

. Previously federal law allowed a credit for state death taxes on the. The additional exemption up to 25000 applies to the. The first 25000 applies to all property taxes.

The shortfall is made up of high property tax rates for Florida real estate. But if you live in Florida. Why are property taxes so high in Florida.

Each county sets its own tax rate. The exemption is 117 million for 2021. No there is no Florida capital gains tax.

Because local governments collect property taxes in Florida the tax rate can differ from one place to another. Owns real estate and makes it his or her permanent residence Is age 65 or older Household income does not exceed the income limitation see Form DR-501 and. A federal change eliminated Floridas estate tax after December 31 2004.

There are also special tax districts. Ad valorem taxes are based on. Florida Property Tax is based on market value as of January 1st that year.

Does Florida Have Capital Gains Tax. Property taxes in Florida are right in the middle of the pack nationwide with an average effective rate of 083. On average the Florida property tax rate sits at 083 with homeowners paying.

The average Florida homeowner pays 1752 each year in real property taxes although that amount varies between counties. Taxes in Florida Explained For decades Florida has had one of the lowest tax burdens. Up to 25 cash back Florida allows for reduced property taxes if the homeowner meets certain requirements.

The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. Meet Florida real estate agents near you and save thousands. There is no estate tax in the state of Florida.

The average property tax rate in Florida is 083. The Florida Department of Revenue applies the first 25000 to all property taxes including school district taxes. Florida does not charge state income tax meaning local authorities get no revenue from residents earnings.

Florida doesnt have a personal income tax nor does it have an estate tax or an inheritance tax. Florida Estate Tax. Counties in Florida collect an average of 097 of a.

It does however impose a variety of sales and property taxes and some are. Florida property and sales tax support most state and local government funds since the state. Dixie 503 Holmes 555 Jackson 630 Hamilton 668 Washington 687 Liberty 695 Calhoun 725.

Real estate property taxes also referred to as real property taxes are a combination of ad valorem and non-ad valorem assessments. Florida Counties With the LOWEST Median Property Taxes. Property taxes apply to both homes and businesses.

In 2020 there is an estate tax exemption of 1158 million meaning you dont pay estate tax unless your estate is worth more than 1158 million.

Buying A Manufactured Home Here Is What You Need To Know About Property Taxes And Utility Hookups

Florida Tax Rates Rankings Florida State Taxes Tax Foundation

2018 Florida Property Tax Appeal Deadlines Are Approaching Firstpointe Advisors Llc

Florida Real Estate How Much Will It Cost Nmb Florida Realty

17 States With Estate Taxes Or Inheritance Taxes

Florida Property Taxes Real Estate Taxes Explained List Of Counties Real Estates

How Are Property Taxes Handled At A Closing In Florida

Florida Property Taxes Explained

Understanding Your Tax Bill Seminole County Tax Collector

How Do Tax Deed Sales In Florida Work Dewitt Law Firm

What Is Florida County Real Estate Tax Property Tax

Florida Property Taxes Mls Campus

2022 Real Estate Tax Conference Tax Section Of The Florida Bar

Are There Any States With No Property Tax In 2022 Free Investor Guide

Florida Real Estate Taxes What You Need To Know

Florida Property Taxes Explained

Property Taxes By State 2016 Eye On Housing

In Florida Homeowners Come For The Weather And Stay For The Tax Relief

5 Great Florida Property Tax Appeals Numbers And Dates South Florida Law Pllc