b&o tax credit

Systems installed between 2006. E-File Your Tax Return Online.

B O Tax Credit Program Puyallup Main Street Association

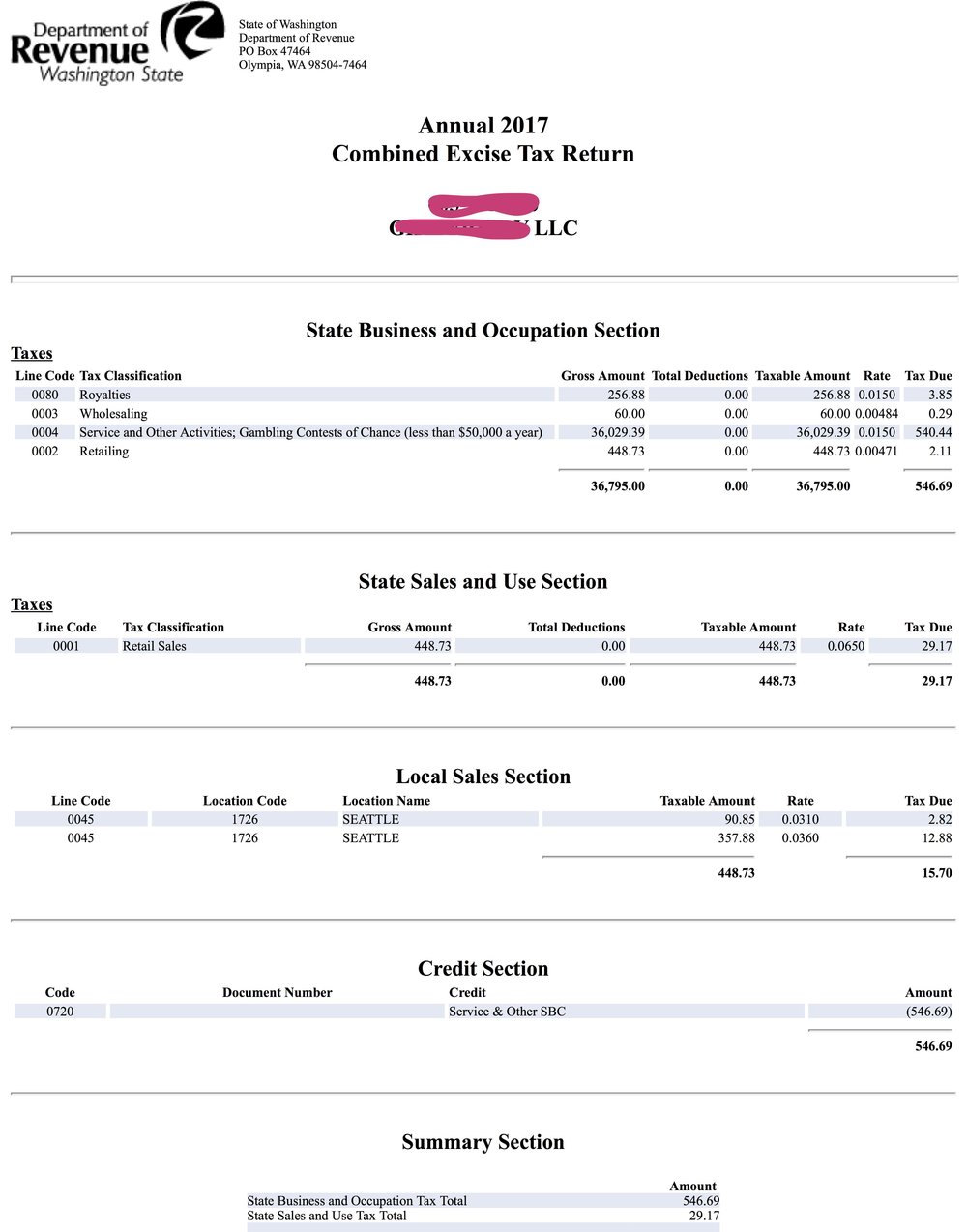

Your business does not owe general business and occupation BO tax if you had annual income of less than 100000.

. Donate to the EDA and receive a state BO tax credit of 75 of the donation amount. BO Tax 2022 Quarterly Return. The Manufacturing BO tax rate is 0484 percent 000484 of your gross receipts.

In 2022 when you go to pay your BO. Check Out the Latest Info. Browse Our Collection and Pick the Best Offers.

For businesses that exceed that amount a tax credit is granted so that tax. Receive a federal tax deduction for the remaining 25. If you do not receive your bill by August 8 call the New Castle County billing information line at.

You can make the donation by sending a check to the following address. For products manufactured and sold in Washington a business owner is subject to both the Manufacturing. If you qualify the Department of Revenue provides.

Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. Your BO tax liability is under. Make a pledge of as little as 1000 to Puyallup Main Street Association beginning January 10 to March 30 2022 pay the pledge to PMSA by November 15th and 75 of your pledge will be.

FOR THE UPCOMING TAX YEAR THIS CREDIT IS NOT PERMITTED RETROACTIVELY SEND YOUR APPLICATION TO THE APPROPRIATE COUNTY. Use External Credits when one of your business activities. But you still must file and report that to the City even.

There is levied upon and shall be collected from any person engaging or continuing in any business or other activities set forth in Section 78703 annual privilege taxes in an amount. BO is defined as a tax on the value of products the gross income of the business or the gross. Small business tax relief based on income of business.

This is a way to direct your tax dollars right back. 71 for monthly taxpayers. 841 for annual taxpayers.

This rule explains the business and occupation BO tax credit for small businesses provided by RCW 82044451. If your system was installed after January 1 2022 you likely qualify for the newly increased 30 tax credit under the Inflation Reduction Act. Learn More at AARP.

The credit is taken against the BO tax for each new employment position filled and maintained by qualified businesses located in eligible areas. Ad Bo tax credit. STATE OF DELAWARE APPLICATION FOR.

Puyallup Main Street Association. Business Occupation BO Tax. 211 for quarterly taxpayers.

Full-Time Employees For a full-time. Use Internal Credits when both your business activities manufacturing and retail sales for example occurred within Seattle. The 2022 tax billing statements will be mailed during the third week of July 2022.

B O Tax. 6 Often Overlooked Tax Breaks You Dont Want to Miss. BO Tax 2021 Annual Return.

In Washington the gross receipts tax is called the business and occupation BO tax. The Wilmington Senior Property Tax Assistance Program targets seniors who have paid off their mortgages but who are facing foreclosure due to delinquent City property taxes or. Your business is eligible for a tax credit worth up to.

For businesses paying BO taxes your organization financially benefits from investing in Sumner Main Street Association.

Washington Business And Occupation Tax Does Not Need Physical Presence For Nexus

Washington Main Street B O Tax Incentive Program Bainbridge Island Downtown Association

B O Tax Blog Seattle Business Apothecary Resource Center For Self Employed Women

Tax Credit Incentive Stevensonmainstreet

Washington State B O Tax Guidelines For Covid Relief

The Basics Stevensonmainstreet

Main Street Tax Credit Incentive Program Wenatchee Downtown Association

What Types Of Taxes Must I File As A Washington Based Therapist

Allocate Your B O Tax Historic Downtown Kennewick Partnership

Business And Occupation B O Tax Washington State And City Of Bellingham

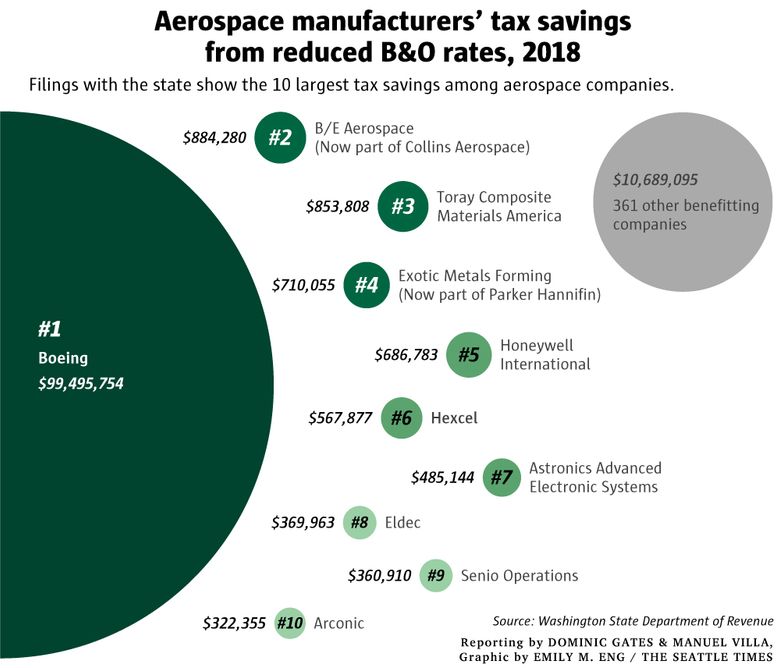

Boeing May Give Up Its Major Washington State Tax Break To Avoid European Tariffs The Seattle Times

Business Occupation Tax Bainbridge Island Wa Official Website

Business And Occupation Tax Credit Commute Seattle

Main Street Tax Incentive Program Downtown Bellingham

Intercompany Transactions How Diligent Documentation Can Help You Avoid B O Tax Liability Aprio

Ghj Changes To Gross Receipts Taxes Washington And Oregon Updates For 2020

B O Tax Credit Program Sumner Main Street Association

Main Street Tax Credit Incentive Program Wenatchee Downtown Association

Wheeling Finance Committee Approves B O Tax Credit Lede News